Navigating Uncertainty: Q2 Market Snapshot for SMB Leaders

Market Overview: An Economy in Calibrated Transition

The second quarter of 2025 demonstrated measured economic adjustment rather than dramatic shifts. Key indicators reflect an economy establishing equilibrium and the foundation for sustained growth while businesses and consumers adapt to elevated interest rates and evolving policy frameworks.

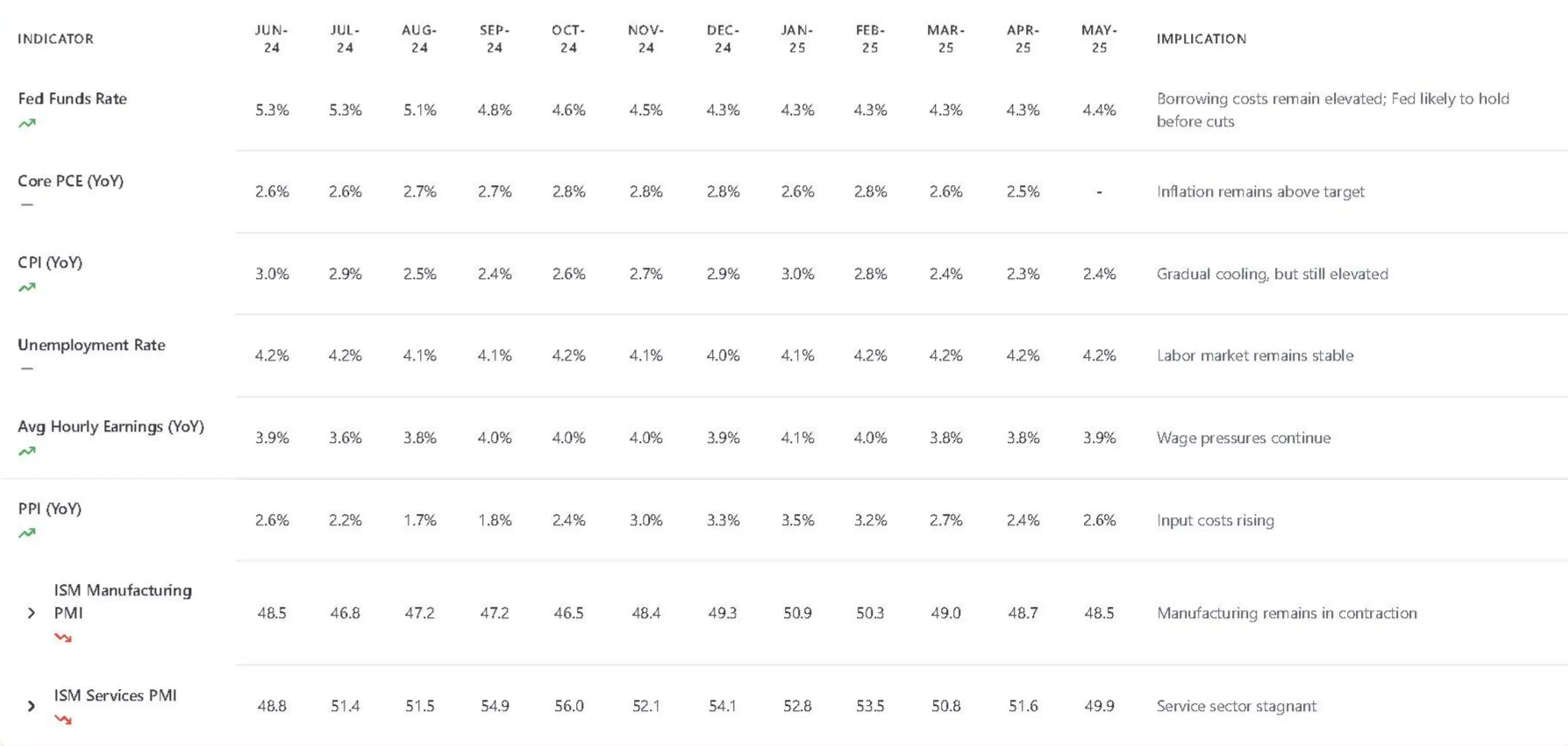

Economic Indicators - 12 Month Time Series

Inflation Demonstrates Constructive Progress

Consumer Price Index trends represent the quarter's most encouraging development, declining from 3.0% in January to 2.4% in May—meaningful progress toward the Federal Reserve's 2% target. Core Personal Consumption Expenditures remained elevated around 2.6-2.8%, yet the directional movement suggests underlying price pressures are moderating.

The Federal Reserve's decision to maintain the funds rate at 4.3-4.4% throughout the period reflects confidence in current policy efficacy. This measured approach prioritizes sustainable disinflation over reactive adjustments.

Producer Price Index volatility, rising from 1.7% in August to 2.6% in May, indicates that while consumer-facing prices moderate, input cost management remains a critical business consideration. This dynamic creates differentiation opportunities for companies with effective supply chain strategies.

Labor Market Demonstrates Fundamental Strength

Employment indicators reflected stability throughout the quarter, with unemployment maintaining 4.2%—a level indicative of near full employment conditions. More importantly, average hourly earnings growth of 3.9% year-over-year substantially outpaced the 2.4% Consumer Price Index, generating meaningful real wage gains for workers.

According to Jia-Mang Ten, Senior Analytics Officer at Libertas, "The consumer is healing and momentum is building—we're patiently waiting to see where that takes us."

This wage-inflation relationship represents a critical dynamic for small business planning. While labor costs continue advancing, consumer purchasing power is simultaneously strengthening, supporting demand across sectors. The consistency of these employment metrics suggests economic transitions will likely unfold gradually rather than abruptly.

Business Activity: Stability Over Growth

The ISM indicators tell the story of an economy taking a measured pause rather than experiencing decline. Manufacturing PMI registered 48.5 in May, indicating modest contraction but remaining well above levels typically associated with significant economic stress. The Services PMI at 49.9 similarly reflects tempered activity rather than meaningful deterioration.

Both readings hover close to the 50 thresholds—the line that separates expansion from contraction—suggesting businesses are making thoughtful adjustments rather than dramatic cuts.

When we combine these readings with the stable employment data we've seen, it becomes clear that companies are calibrating capacity and investment plans carefully. For those in the financing business, this translates to steady demand for working capital even if growth financing requests have moderated.

Small Business Optimism: Progress Amid Persistent Challenges

The shift in small business sentiment during Q2 reveals a nuanced story. For the first time in 2025, small business optimism increased in May, according to the National Federation of Independent Business (NFIB), an encouraging sign that entrepreneurs are beginning to see clearer paths forward.

However, this optimism coexists with elevated uncertainty. Tax policy concerns have moved to the top of business owner priorities, ranking as the single most important problem for the first time since December 2020. Additionally, businesses making direct tariff payments have seen costs surge 91% compared to 2022 averages, according to Bank of America Institute research, creating real operational pressures that require careful navigation.

Credit Markets: Navigating Tighter Standards

Credit conditions have undergone meaningful tightening compared to the historically accommodative standards of recent years, creating substantive challenges for businesses seeking financing. Traditional lenders have implemented more stringent underwriting criteria, while approval processes have become increasingly complex and protracted.

David Waill, Senior Managing Director of Credit at Libertas, provides perspective on this environment: "It's not clear to me that we're in a traditional economic cycle. We still see excessive focus on where the Fed is setting rates, but the real story is how businesses are adapting to sustained uncertainty."

This environment has created opportunities for specialized lenders with deep expertise in business fundamentals. Libertas has observed companies implementing more strategic approaches, executing proactive inventory investments to hedge against cost escalation, while others prioritize operational flexibility. "We look carefully at businesses that might be affected by trade policy changes," Waill notes, "while recognizing opportunities in defensive sectors like healthcare services where demand remains consistent."

Rather than applying uniform tightening across all sectors, Libertas collaborates closely with businesses to understand specific challenges and structure appropriate solutions. "While uncertainty creates challenges across the market, it also highlights the value of our specialized approach," Waill explains. "Our expertise in evaluating businesses holistically allows us to serve quality companies that may face financing gaps as traditional lenders become more cautious."

The Road Ahead: What the Indicators Signal

Analysis of the data trends within our indicator framework reveals several key transitions that will likely influence the second half of 2025.

Federal Reserve Policy Trajectory: With the funds rate stabilized around 4.3-4.4% and Consumer Price Index demonstrating consistent downward momentum, conditions may be aligning for eventual monetary accommodation. However, Producer Price Index volatility suggests the Federal Reserve will likely maintain its measured approach, prioritizing sustained inflation control over aggressive policy adjustment.

Wage-Price Equilibrium: Current dynamics present an encouraging mix. Hourly earnings growth at 3.9% paired with CPI at 2.4% represents an optimal balance where workers achieve purchasing power gains without triggering broad-based inflationary pressures. Maintaining this equilibrium will prove critical for continued economic stability.

Business Sentiment Indicators: ISM readings approaching the 50 thresholds indicate an economy in transition rather than recession. For business leaders, this environment suggests strategic positioning and operational efficiency will take precedence over rapid expansion initiatives.

Policy Framework Clarity: Ongoing legislative discussions regarding tax and trade policies are progressing toward resolution, providing businesses with enhanced frameworks for long-term strategic planning despite near-term uncertainty.

Staying Ahead of the Curve

The current environment presents both challenges and opportunities for businesses willing to adapt strategically. Input cost pressures from rising PPI, combined with tighter credit standards, require more thoughtful capital planning than we've seen in recent years. At the same time, improving wage-inflation dynamics and stabilizing business activity suggest that companies with strong fundamentals can continue to grow.

"Our job is to see businesses clearly, even when the world gets blurry," Waill concludes. "That starts with asking the right questions and understanding both macro trends and company-specific opportunities."

Success in this environment often comes down to working with partners who understand both the challenges and the solutions. At Libertas, we're committed to providing not just capital, but the insights and flexibility that help businesses turn periods of uncertainty into competitive advantages.

As economic conditions continue to evolve, this quarterly series will track the indicators that matter most to business leaders, always with an eye toward practical applications and emerging opportunities.

This market analysis represents the first in Libertas' quarterly series examining economic conditions and their impact on small and medium-sized businesses. Future editions will continue to provide balanced analysis of market trends and their practical implications for business leaders.